Federal Budget Deficits Grow During Recessions Because

GDP Federal Spending Non-federal Spending Net Exports. A possible explanation for the persistence of the US.

Federal Deficits And The National Debt Principles Of Economics 2e

Both tax revenues and transfer payments decrease.

. Tax revenues increase while transfer payments decrease. Job creation gives more people money to spend which further boosts growth. Recessions are associated with budget deficits.

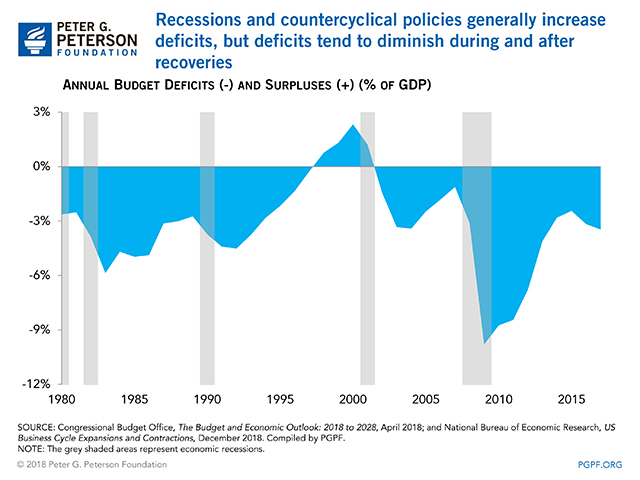

The federal budget deficit is not an accident. Monetary and fiscal policy TOP. For any given year the federal budget deficit is the amount of money the federal government spends minus the amount of revenues it takes in.

Both tax revenues and transfer payments decrease. Commerce slowed unemployment reached rates not seen since the Great Depression and many businesses were forced to close. Its a result of expansionary fiscal policy.

Economic growth by formula requires growing dollar supplies. Federal budget deficits generally grow during recessions because. Federal budget deficits is that.

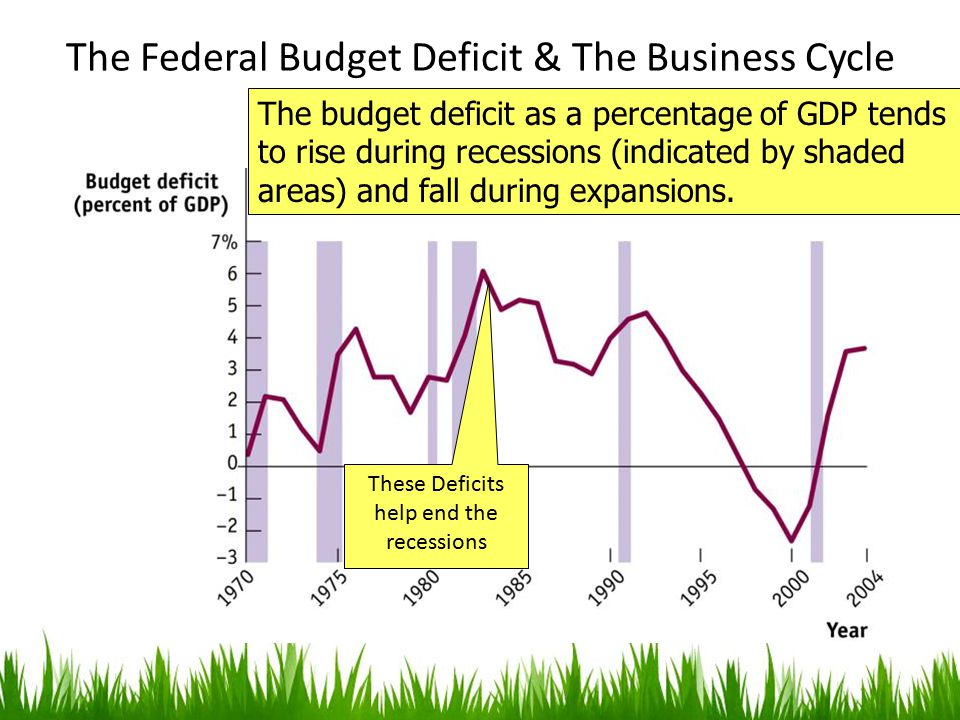

Federal budget deficits generally grow during recessions because. Tax revenues decrease while transfer payments increase. The trend is reversed during expansion.

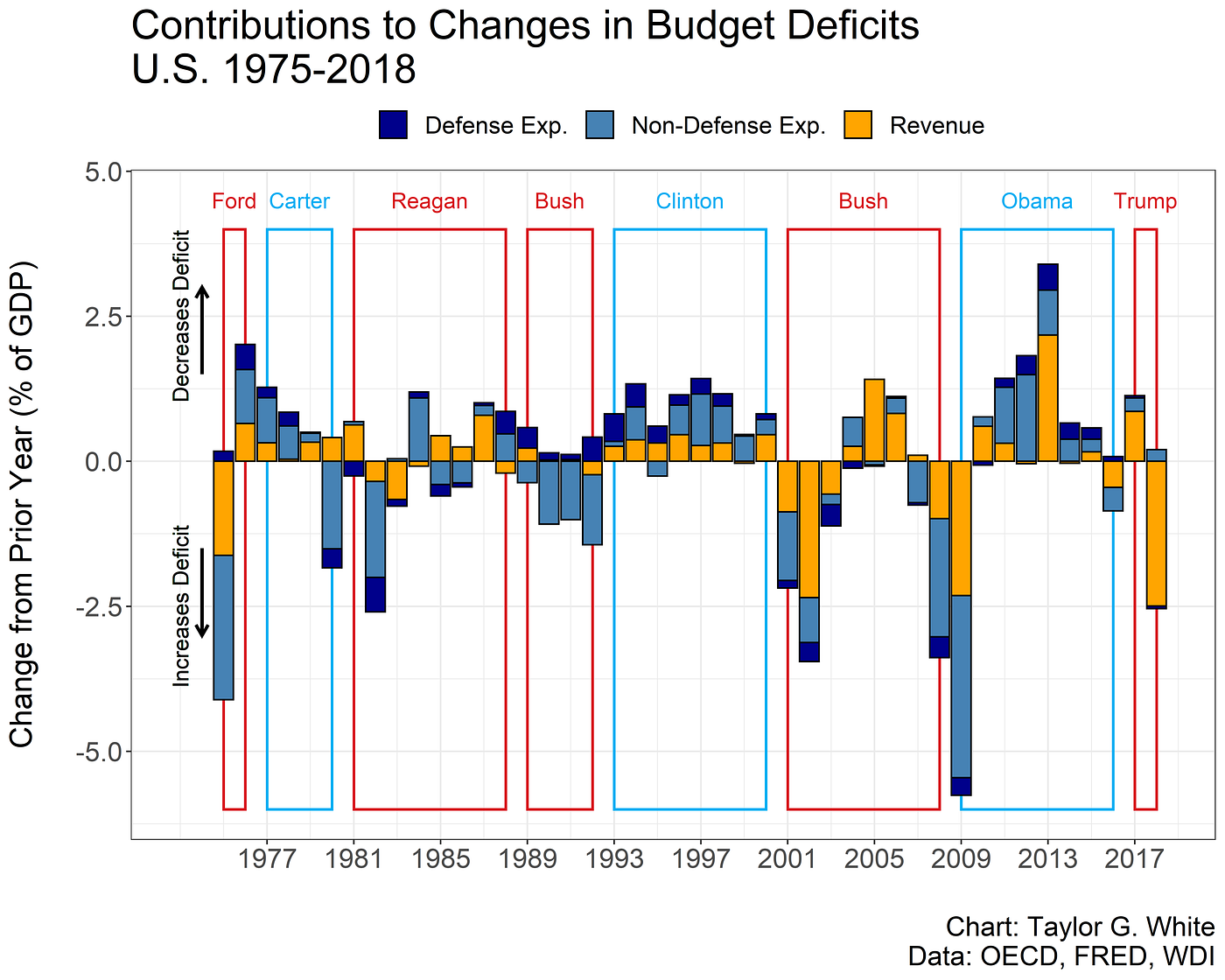

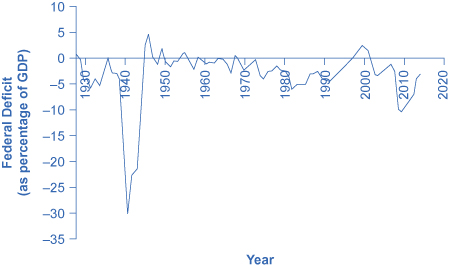

Because of factor one the government receives less money from taxpayers due to a recession while factors two and three imply that the government spends more money than it would during better times. Positive which increases tax receipts in relation to government expenditures. Federal Deficits Growing Debt and the Economy in the Wake of COVID-19 Congressional Research Service 1 Introduction The Coronavirus Disease 2019 COVID-19 pandemic caused widespread economic disruption.

Federal budget deficits generally grow during recessions because Select one. Both tax revenues and transfer payments increase. Both tax revenues and transfer payments increase.

Negative which reduces tax receipts in relation to government expenditures. Both tax revenues and transfer payments decrease. Tax revenues decrease while transfer payments increase.

Tax revenues decrease while transfer payments increase. The president and Congress intentionally create it in each fiscal years budget. GDP reduction caused by deficit growth.

Federal budget deficits generally grow during recessions because a. Enacting procyclical fiscal policies during a period of economic growth can have significant budgetary and economic. Asked Aug 15 2017 in Economics by rosielea.

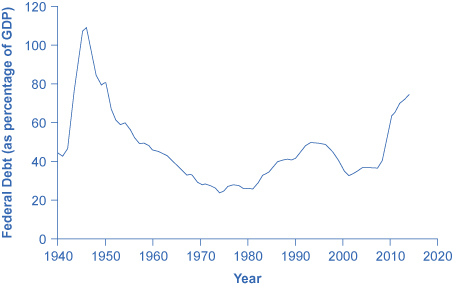

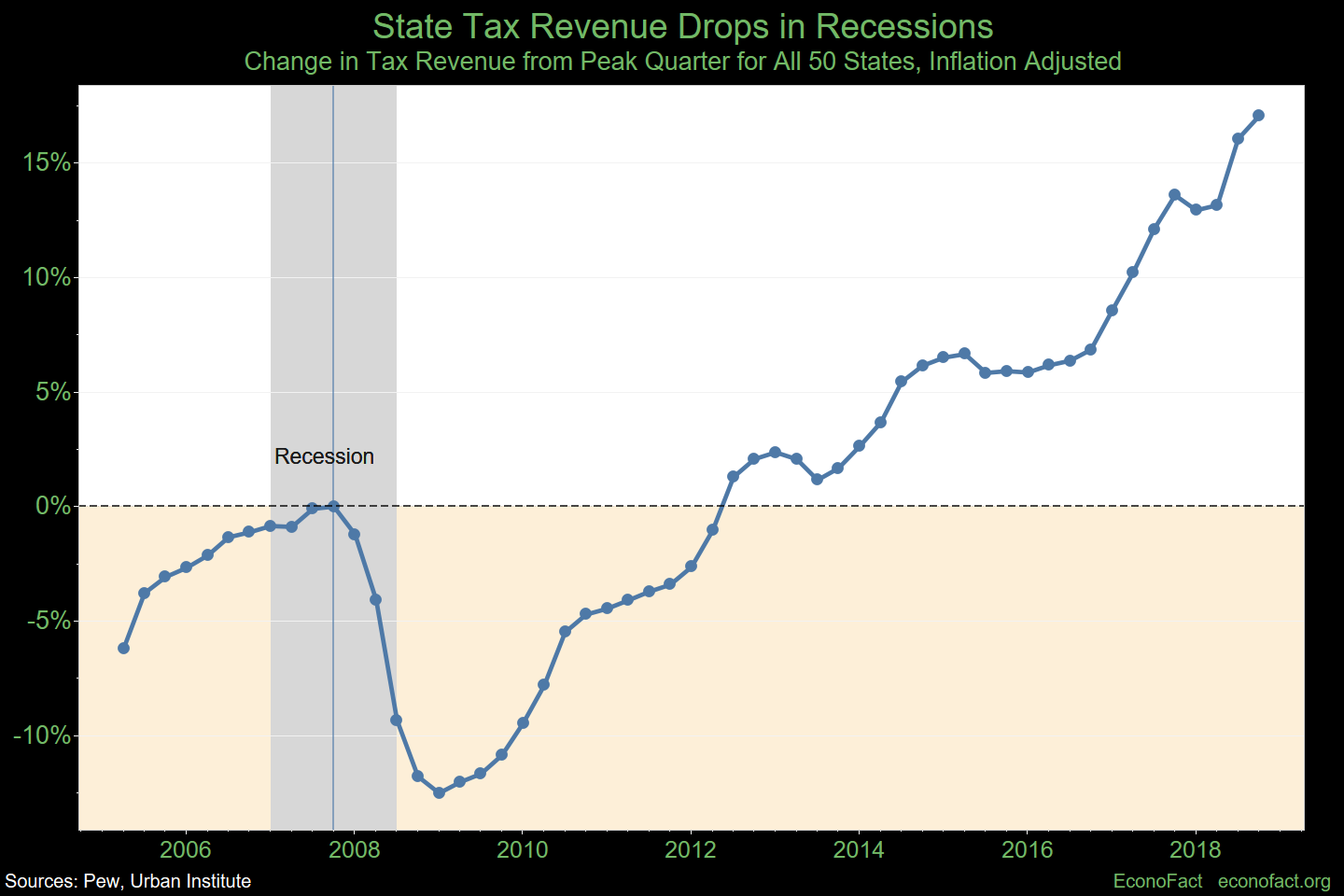

Tax cuts also expand the economy. Running a procyclical fiscal policy by providing stimulus in the form of tax cuts and increased spending. The risks to federal finances from even a mild recession let alone a more severe recession given the current level of deficits are substantial and should be taken into consideration in future budgets.

The trend is reversed during expansion. Both tax revenues and transfer payments decrease b. If the deficit critics were correct you would expect to see.

Even without changes in fiscal policy budget deficits increase during recessions e. Thats because government spending drives economic growth. This pattern is the result of the US.

The deficit drives the amount of money the government has to borrow in any. Federal budget deficits grow during recessions because. Federal budget deficits generally grow during recessions because tax revenues decrease while transfer payments increase The crowding-out effect indicates that budget deficits.

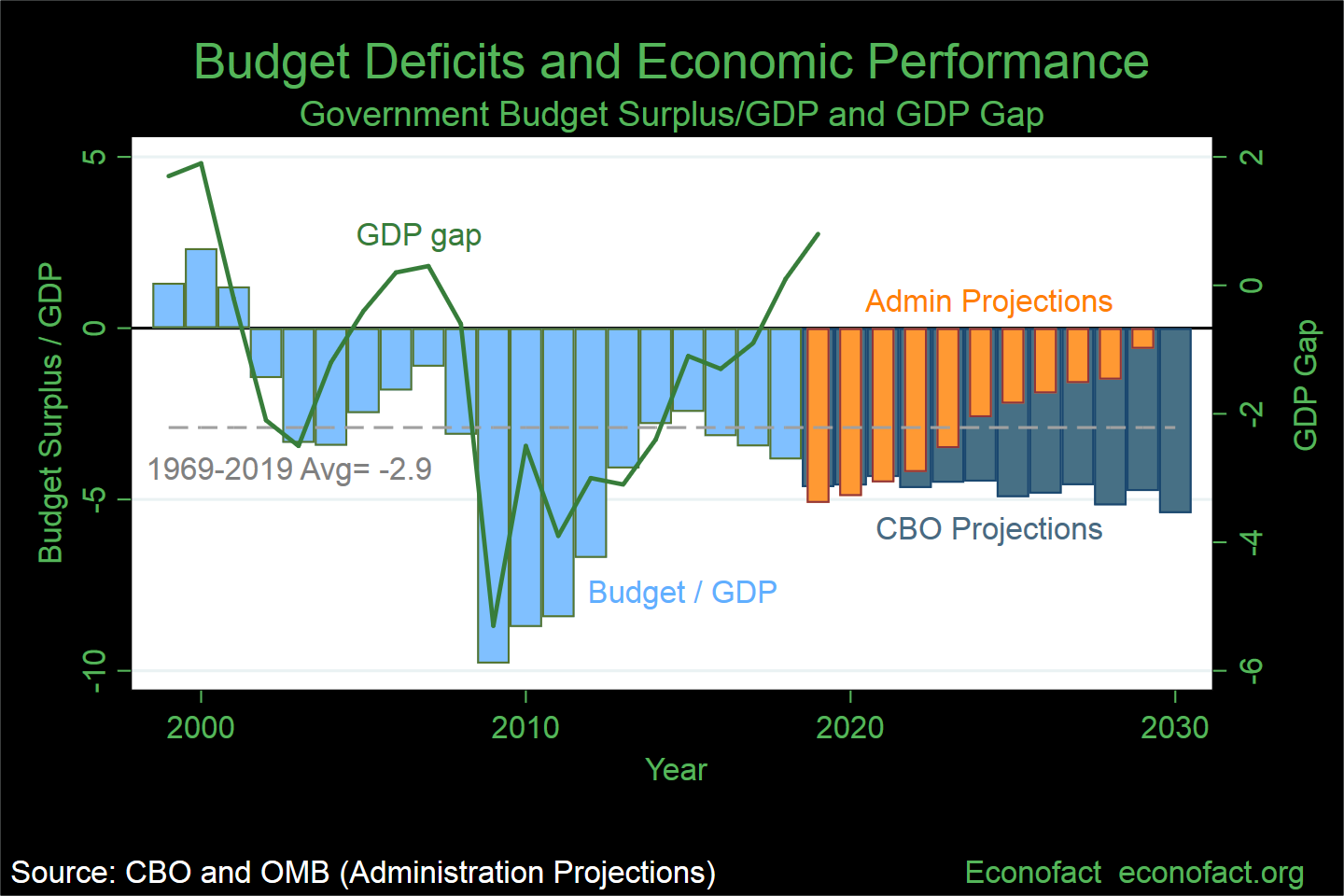

Structural deficits though are budget conditions that produce deficits in all economic conditions because the government is structured in a way. The federal deficit is growing during a period of economic expansion a pattern that is highly unusual. Federal budget deficits grow during recessions because a.

Because many workers have lost their jobs their is increased use of government programs such as unemployment. Tax revenues decrease but transfer payments are unchanged. But during bad times federal budget deficits can help shore up the economy.

Earlier administrations may have contributed to current budget deficits If the deficit is increasing because of the effects of the automatic stabilizers. WHY DO GOVERNMENT BUDGET DEFICIT GROW DURING A RECESSION 1. Tax revenues decrease while.

Contributes to the efficiency of the federal budget process. Recessions caused by deficit growth. Both tax revenues and transfer payments increase.

The economy goes into recession costing many workers their jobs and at the same time causing corporate profits to. Three important budget concepts are deficits or surpluses debt and interest. Both tax revenues and transfer payments decrease b.

Money starts flowing out of the government faster than it comes in causing the governments budget to go into deficit. Zero which causes neither tax receipts nor government expenditures to grow. In order to overcome economic depression the federal government will prepare budget deficit for every year.

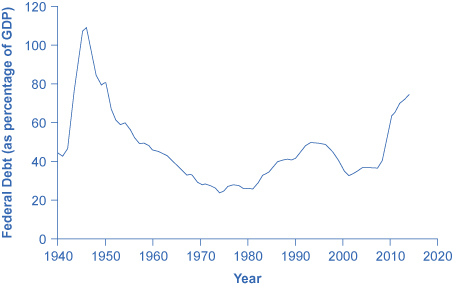

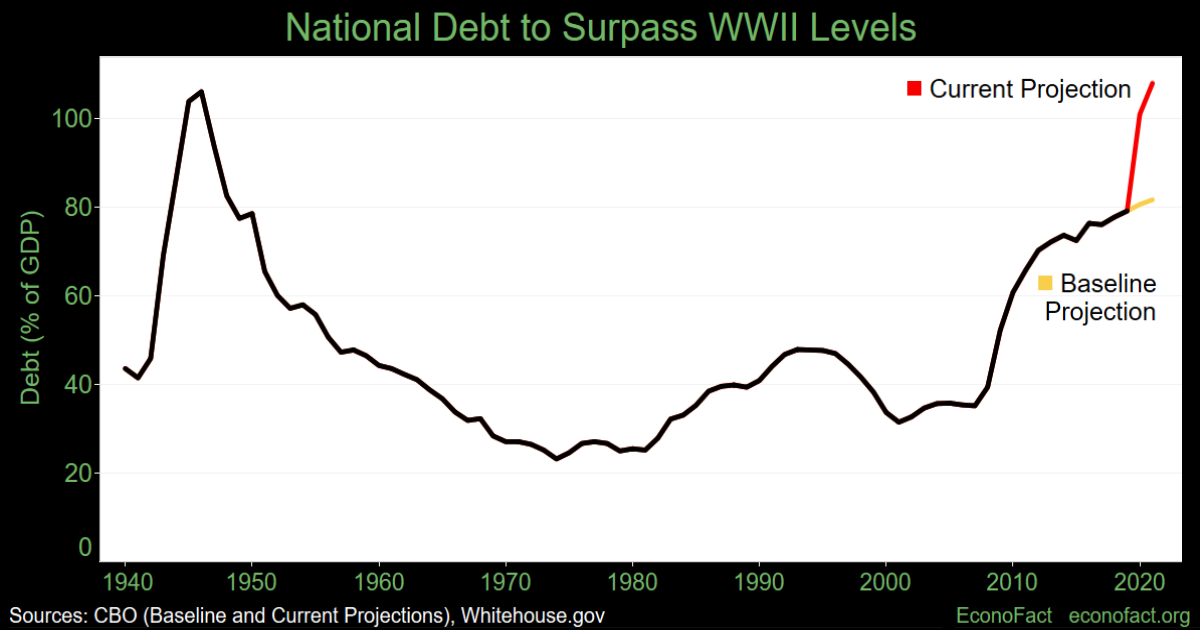

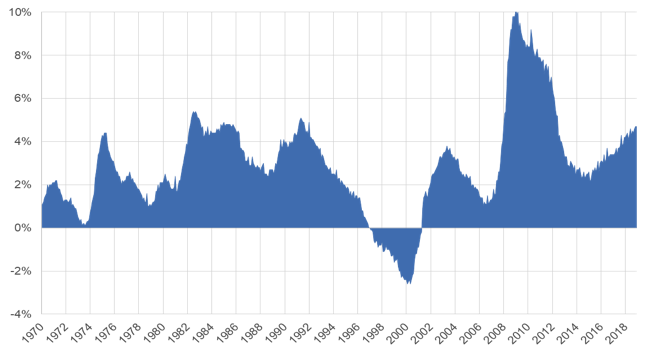

Both tax revenues and transfer payments increase c. Budget deficits tend to grow during recessions because real GDP growth is. Deficits Debt and Interest.

The resulting decline in revenues and increase in program spending from recessions means much larger deficits and thus an accumulation of debt. Tax revenues increase while transfer payments decrease. Budget Philosophies and Deficits 67.

The governments deficit automatically widens during recessions as tax receipts fall and social expenditures such as unemployment insurance rise without any change in policy The average full-employment deficit between 1965 and 2018 was just 27 percent of GDP. Because the economy itself will grow a little faster. Federal budget deficits generally grow during recessions because a.

In theory deficits should shrink or disappear when the economy is growing since the government does not have as many expenses eg unemployment payments and increase only during economic slowdowns or recessions. A-Budget deficits emerge during recessions because net taxes fall when incomes fall. A cyclically balanced budget is one in which surpluses during recessions are balanced by deficits during expansions.

GDP increases caused by deficit reduction. Both tax revenues and transfer payments increase.

Which Party Adds More To Deficits By Taylor White Towards Data Science

Risks Of Growing Debt Vs Fiscal Stringency In The Covid 19 Crisis Econofact

Why Does The Government Budget Deficit Increase During A Recession Even Without Countercyclical Fiscal Policy Quora

When Will U S Federal Budget Deficits Matter Miracle Mile Advisors

The Risks Of Running Up Deficits When The Economy Is Good

Federal Deficits And The National Debt Principles Of Economics 2e

Sense And Nonsense About Budget Deficits

Chapter 16 Lecture Fiscal Policy Ppt Download

States Face Daunting Budget Gaps What Can Be Done Econofact

Government Budget Deficits And Economic Growth Econofact

Long Term Tendencies In Budget Deficits And Debt In Imf Working Papers Volume 1995 Issue 128 1995

An Update To The Budget Outlook 2020 To 2030 Congressional Budget Office

Anthony Patrick O Brien Ppt Download

Government Budget Balance Wikiwand

Part 2 Deficit And Debt Chapter Chapter Goals Define The Terms Deficit Surplus And Debt And Distinguish Between A Cyclical Deficit And A Structural Ppt Download

29 Chapter Fiscal Policy Krugman Wells Ppt Download

Fiscal Policy And The Trade Balance Principles Of Macroeconomics 2e

Comments

Post a Comment